Contents

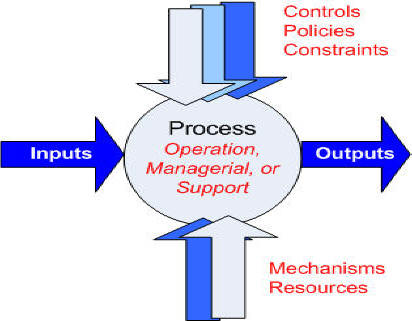

To jeden z najpopularniejszych modeli rynkowych, który reprezentujemy jako TMS Brokers. Trader, otwierając pozycję opartą o wartość Aplikacja Amarkets: Dostęp do rynków finansowych danego instrumentu, zawiera transakcję z brokerem. Makler z kolei zabezpiecza ją pod swoim szyldem w systemie międzybankowym.

Mówiąc skrótowo, należy w odpowiednim momencie kupować oraz sprzedawać. Najczęściej stosowane strategie walutowe inwestorów, to np. Ta metoda polega na tym, aby pożyczać pieniądze w państwach, których stopy procentowe są niskie i tanie kredyty. Aby lokować kapitał w instrumentach, które denominowane są w walutach krajów z wysokimi stopami procentowymi. Jeśli w czasie inwestycji w kraju z wysokimi stopami procentowymi inflacja okaże się dużo wyższa niż w państwie, w którym trader się zapożyczał, jego zysk może okazać się pozorny. Osoby mniej zaznajomione z inwestowaniem powinny jednak skupić się na najważniejszych walutach i nabywać je raz na jakiś czas, tak, aby uśrednić cenę zakupu.

W gronie rynków wschodzących obiektem pożądania nie polski złoty a korona czeska

Kursy walut zmieniają się w czasie – czasami ich ceny rosną, czasami spadają w stosunku do innych cen walut. W związku z tym stały się one również popularną metodą na inwestycje. Janka, biorąc pod uwagę kursy tych walut, to tak – opłaca się. Ważne, żeby zrobić to jak najszybciej, bo kurs złotego względem tych walut cały czas spada.

Takim, który oferuje więcej niż standardowe konto walutowo-oszczędnościowe. Zasadniczą różnicą w tym przypadku jest brak dodatkowych opłat za bezpośrednią wymianę walut. Co więcej – w kwestiach rozliczania podatków – ich regulacja przebiega według stawki od zysków kapitałowych, a nie standardowego podatku dochodowego. Na świecie istnieje wiele różnych walut, dla których zalicza się również egzotyczne, np.

- Po czym straciła maksymalnie 6 proc., a kurs EUR/CZK osiągnął zaledwie kilkumiesięczne szczyty.

- Zyski z tego rodzaju inwestycji mogą być zwielokrotnione dzięki zastosowaniu lewara.

- „walut towarowych”, wielu ekspertów widzi duży potencjał w inwestycji w dolara australijskiego.

Dzięki niemu powinieneś móc już określić, czy przechowywanie części oszczędności w walutach będzie dla Ciebie dobrym wyborem. Jeśli tak, to pamiętaj, że najlepszym miejscem do ich nabywania i sprzedawania są kantory internetowe. Wspomniane pary charakteryzują się najwyższą płynnością (mają aż ok. 80% udziału w całym obrocie na rynku forex) i niskim spreadem, co daje dużą swobodę inwestowania i stosowania strategii krótkoterminowych. Pamiętaj jednak, że każda z par ma swoją specyfikę (często dość złożoną), którą koniecznie musisz dobrze poznać przed rozpoczęciem handlu.

Jak inwestować w waluty, by na nich zarabiać?

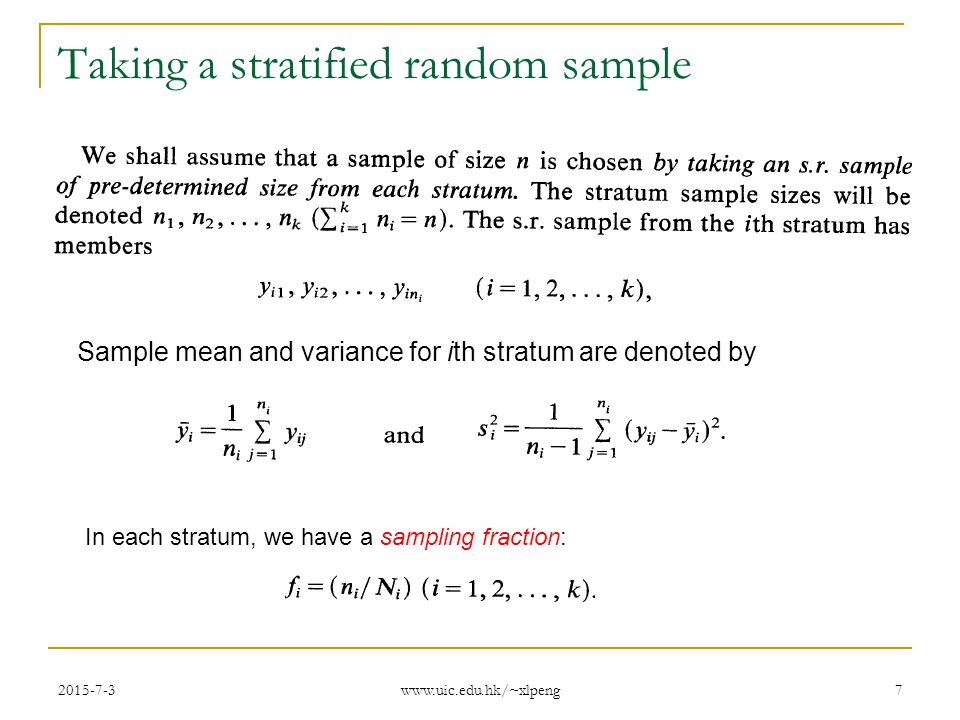

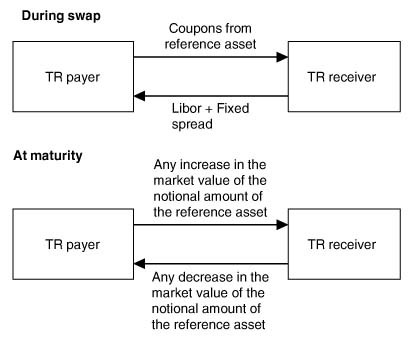

Duża nerwowość na tradycyjnej giełdzie sprawia,żeinwestorzyprzenoszą wolne środki iszukają dywersyfikacji portfela.Ciekawym rozwiązaniem tego problemu może byćrynek Forex. Jego główną zaletą jest ogromna płynność i możliwość zarabiania na swapach. 78% kont inwestorów detalicznych odnotowuje straty pieniężne podczas handlu CFD. Aby poznać podstawy inwestowania w waluty, zacząć trzeba od poznania podstawowych definicji.

Mają wysoką płynność, co oznacza, że są łatwo dostępne w niemal każdej ilości, niezależnie od pory dnia i nocy. Pary egzotyczne są zwykle niepłynne, z dużymi spreadami i mniejszą liczbą organizatorów rynku. Przykłady egzotycznych par walutowych obejmują na przykład południowoafrykańską randę , dolar hongkoński lub peso meksykańskie . W tym celu, na początku powinniśmy sobie jasno powiedzieć, kiedy dana waluta jest tania, a kiedy kosztowna.

Jednakże chyba największą zaletą eToro jest wspomniana już wcześniej funkcja CopyTrader. Jest ona idealnym rozwiązaniem dla tych, którzy dopiero zaczynają swoją przygodę z inwestowaniem. Otóż na eToro widoczne są profile najlepszych inwestorów i ich osiągane wyniki. W bardzo łatwy sposób możemy „podpiąć się” pod jego transakcje i dzięki temu, system niejako sam będzie inwestował za nas nasze środki. Inwestycje będą dokładnie takie same (pod względem procentowym) jak wybranego przez nas inwestora. Dla przykładu, jeśli ze swoich środków inwestuje on 10% w złoto, system z naszych środków także pobierze 10% i zainwestuje w ten kruszec.

Wyjątkowo długo Rada Polityki Pieniężnej kazała czekać 9 listopada na decyzję dotyczącą stóp procentowych. Pierwszą opcją jest inwestycja w złoto fizyczne, czyli w złote sztabki lokacyjne lub monety bulionowe. Takie produkty nazywane są złotem inwestycyjnym i mają tę zaletę, że zawierają w sobie niemal wyłącznie kruszec. Idealnie nadają się do celów stricte inwestycyjnych, a konkretniej – do długoterminowego przechowywania majątku w złocie. Patrząc w dłuższym okresie, kurs liry tureckiej pozostaje w permanentnym trendzie spadkowym, a jedynym okresem względnej stabilizacji była pierwsza dekada XXI wieku. Weryfikując wykres wahań liry tureckiej w przeciągu lat 2016–2021, można zaobserwować, że w 2016 roku kosztowała ona ponad 1,30 zł, by spaść do wartości poniżej 0,50 zł.

Jest wielu brokerów forex. Tylko na koncie maklerskim TMS otrzymasz:

Wedle ogólnej zasady inwestor powinien posiadać w portfolio przynajmniej 5 walut w różnych proporcjach. Te ostatnie zależą od indywidualnych preferencji oraz celu, jaki posiadają inwestycje konkretnych klientów giełdy. Najprościej rzecz ujmując, handel dotyczy krótkoterminowego spojrzenia na rynek, zaś przy inwestycji myślimy raczej o zyskach w długim terminie. Opowiedzieliśmy sobie o walutach, które mogą dobrze sprawdzić się jako aktywa inwestycyjne.

Dlatego postanowiliśmy ułatwić ci wybór i zebraliśmy w jednym miejscu wszystkie waluty, które w roku będą równie stabilne, co w poprzednich latach. Wszystkie treści zamieszczane w serwisie GieldoMania.pl mają charakter jedynie informacyjno-edukacyjny i nigdy nie należy traktować ich jako rekomendacji inwestycyjnych. Poszczególne teksty są jedynie wyrazem osobistych opinii ich autorów. Twórca serwisu GieldoMania.pl nie bierze żadnej odpowiedzialności za decyzje inwestycyjne podejmowane przez użytkowników odwiedzających serwis oraz za usługi oferowane przez firmy prezentowane na stronie.

Kurs sztywny – kurs jest sztywno powiązany z inną walutą. Do tej kategorii reżimów walutowych zalicza się m.in. Jest to sytuacja w której kurs waluty krajowej jest na sztywno powiązany z walutą innego kraju. Bank centralny takiego kraju ma ograniczone pole do prowadzenia polityki pieniężnej. Emisja pieniądza jest możliwa tylko w sytuacji wzrostu poziomu rezerw walutowych.

Jak inwestować w akcje i ile można zarobić?

Euro traci w I kwartale 2022 roku nieco na wartości w stosunku do dolara i franka szwajcarskiego, ale wciąż jest w miarę stabilną walutą, niepodlegającą silnym wahaniom. To czynniki powodujące, że warto rozważyć zainwestowanie w nią swoich pieniędzy. Dolar jest powszechnie akceptowalną walutą i na rynku międzywalutowym Forex uznawaną za walutę typu major.

Jeśli jednak wiesz, że przez nieco dłuższy czas nie będziesz ich potrzebował, możesz rozważyć lokaty walutowe lub ETF-y na waluty. Na tę chwilę oferta tych pierwszych prezentuje się mało atrakcyjnie, ale i tak korzystniej niż rachunków walutowych, które w ogóle nie są oprocentowane. Sytuacja na rynku walutowym zmienia się bardzo dynamicznie, a wszelkie prognozy kursowe szybko tracą na aktualności. Zawsze sam musisz ocenić, czy dany moment jest dobry na zakup wybranej waluty, a jeśli nie jesteś w stanie tego zrobić – rozłóż zakupy na kilka tygodni lub dokupuj walutę regularnie za część oszczędności. Jak widzisz, w 5-letnim okresie różnica pomiędzy minimum a maksimum kursu złotego w aż trzech przypadkach (w parach złotego z dolarem, frankiem i funtem) sięgnęła minimum 30%.

Czy warto kupić funty?

Forex jest najbardziej płynnym i obszernym rynkiem na świecie. Pod względem handlowanych wartości nie ma sobie równych. Według szacunków wartość inwestycji walutowych sięga 5-ciu trylionów dolarów dziennie, co znacznie przewyższa dzienne inwestycje Wskazówki Dotyczące Handlu Walut – 5 Krytycznych Czynników Sukcesu Dla Zwycięskiej Systemu Handlu Forex w akcje na całym świecie. Daniel Kostecki wyjaśnił, że rynek ten można uprzednio przetestować dzięki rachunkom demonstracyjnym. – Zanim zainwestujemy prawdziwe pieniądze, możemy dokonać testu polegającego na hipotetycznym obstawieniu kursu.

Czy warto trzymać oszczędności w euro?

Badanie Eurobarometru z czerwca 2021 roku pokazało, że za taką opcją opowiada się coraz więcej z nas – 56 proc., podczas gdy przy polskiej walucie chciałoby pozostać 41 proc. Polaków. Inwestycje w euro wydają się dobrym pomysłem, zwłaszcza w perspektywie możliwości wprowadzenia tej waluty w Polsce w przyszłości.

Dzięki niskim spreadom i niepobieraniu prowizji oszczędzamy już na samych transakcjach. Dostępne 24h na dobę pozwalają w wygodne dla nas sposób dokonywać transakcji, na przykład z domu, siedząc wygodnie w fotelu. Wystarczy urządzenie mobilne Broker Sberbank: przegląd i kursy i dostęp do Internetu. Samo korzystanie z serwisu jest darowe i intuicyjne. W łatwy sposób dokonamy operacji pieniężnych, będziemy mieli wgląd w transakcje archiwalne i na bieżąco możemy śledzić nasze powiększające się oszczędności.

Jaka jest najbardziej stabilna waluta?

Dla dużej części z nich pierwszym wyborem jest amerykański dolar, który wciąż jest uznawany za najbardziej stabilną i bezpieczną walutę.

Zwyczajowo waluty rezerwowe to dolar amerykański, funty brytyjskie, jeny oraz europejska waluta euro. Jest to najbardziej klasyczny sposób inwestowania w waluty. Jeśli inwestor uważa, że kurs EURO umocni się względem PLN to wymieni złotówki na euro. Wadą takiego sposobu inwestowania jest brak dźwigni finansowej oraz dosyć wysoki spred między ceną kupna, a sprzedaży. Plusem jest natomiast brak ponoszenia kosztów swapu, ponieważ inwestor nie korzystał z dźwigni. Według danych BIS bezkonkurencyjną walutą jest amerykański dolar, który stanowi aż 88,9% obrotu na rynku walutowym.